puerto rico tax incentives act 22

Puerto Rico Tax Incentives. The incentives under Act 22 of 2012 which will expire on December 31 2035 include 100 tax-exemption on dividends and interests and a 100 tax exemption on short-and long-term capital gains after becoming residents.

To become a new bona fide resident of Puerto Rico an individual must have physical presence in the Island for at least 183 days of the year and must not have.

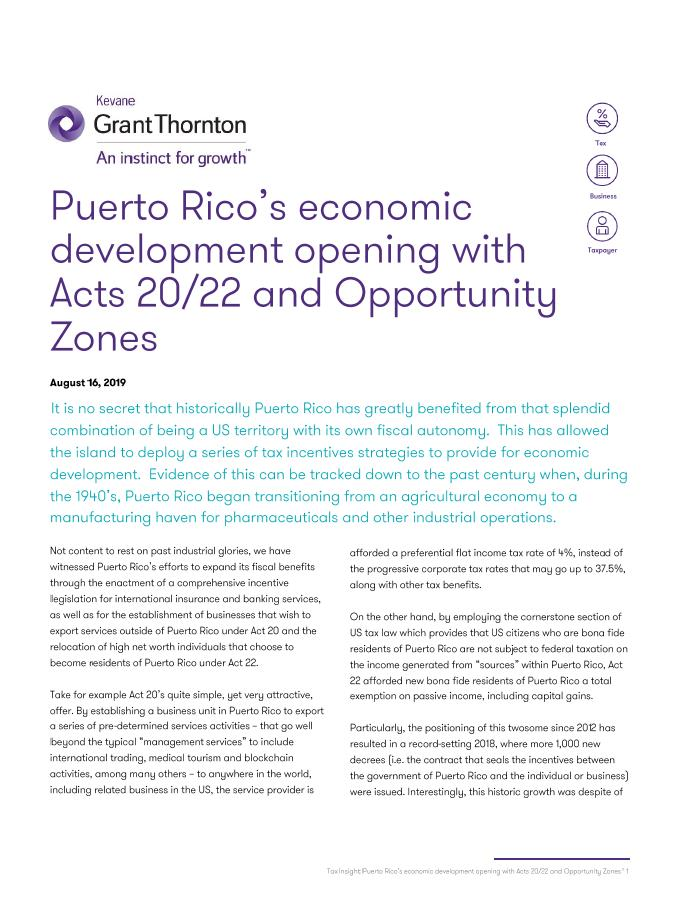

. Special deductions on investments from structure machinery equipment. On July 1 2019 Puerto Rico enacted legislation providing tax incentives for US. The tax laws known as Act 20 the Export Services Act and Act 22 the Individual Investors Act shields new residents residing in Puerto Rico for at least half of the.

Posted on June 16 2021 by admin. The government of Puerto Rico enacted in 2012 Act 22 known as An Act to Promote the Relocation of Individual Investors to prime up the economic development of Puerto Rico by offering non-resident individuals 100 tax exemption on all interest all dividends and all long-term capital gains. Puerto Rico Corporations who qualify for the Act 20 tax exemptions can cut their corporate tax rate to a mere 4.

Under Act 22 bona fide residents of Puerto Rico who qualify can completely eliminate capital gains tax with a 100 tax exemption on assets acquired after the applicant has qualified. In a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business. Acts 20 and 22 were intended to incentivize investment in Puerto Rico promote the exportation of.

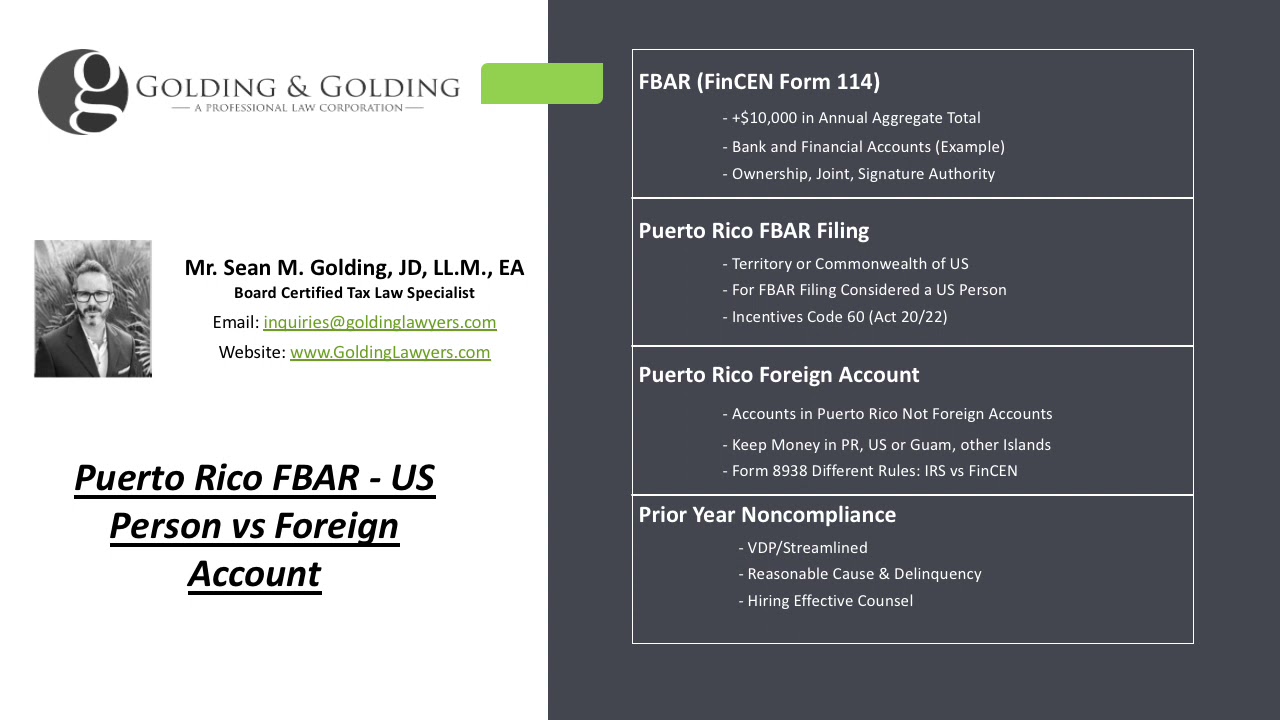

Act 22 is now part of Act 60 Chapter 2 Incentives for Individual Investors. Puerto Rico Tax Incentives. Per the recently published Tax Expenditures Report the fiscal cost of Act 22 is estimated at 29 mm for a single year.

This explicitly includes capital gains earned. The application for an Act 20 Decree must include the payment of a 750 filing fee. Act 22 grantees pay property income and sales and use taxes in Puerto Rico among other state revenues.

Tax credit on purchases of products manufactured or recycled in PR. The portion of the net long-term capital gain generated by a Resident Individual Investor attributable to any appreciation of the Securities or other Assets owned by such Resident Individual Investor before becoming a Resident Individual of Puerto Rico which appreciation is recognized ten 10 years after becoming a Resident Individual of Puerto Rico and before. Citizens that become residents of Puerto Rico.

During 2012 Acts 222012 and 138 -2012 were approved by the Legislative Assembly of Puerto Rico. In January of 2012 Puerto Rico passed legislation making it a tax haven for US. It systematizes dozens of incentive acts Acts 20 and 22 are just the most famous ones that Puerto Rico has enacted over the years.

This is the time to invest in puerto rico. Job created during 1st year of operations. Chapter 2 Individuals Previously known as Act 22 Annual charitable donation.

Americans who move existing or. Puerto Rico Taxes Incentives ACT 20 22 27 73 Other PR Tax Laws PR Tax Incentive Puerto Rico has created an aggressive tax incentive program to connect with the global economy in order to establish an ever-growing array of service. The purpose of these measures is to provide incentives to individuals who have NOT been residents of Puerto Rico during the past 15 years to become residents of Puerto Rico.

If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investors. Citizens that become residents of Puerto Rico. Tax credit on Research and Development RD Activities.

Between 2015 mid 2019 these grantees generated 703 mm in local consumption activity. Of particular interest are Chapter 2 of Act 60 for Resident Individual Investors and Chapter 3 for Export Services which shield new residents who live in Puerto Rico for at least half the year from paying most federal income taxes. The law came into effect on January 1 2020 and altered previous legislation.

Act 22 seeks to attract new residents to Puerto Rico by providing a total exemption from Puerto Rico income taxes on all interest and dividends realized after the individual becomes a bona fide resident of Puerto Rico. In order to encourage the transfer of such individuals to Puerto Rico the Acts completely exempt from. 27 2021 the Internal Revenue Service IRS announced a new compliance campaign focusing on the Puerto Rico Act 22 now Act 60.

Under the new law grantees will need to make a 10000 annual charitable donation 5000 of that donation will go to a government-approved list of charities and 5000 may go to any Puerto Rican charity of your choice. Individual Investor incentive previously covered under Act 22 of 2012 known as the Act to Promote the Relocation of Individual Investors to Puerto Rico was enacted to stimulate Puerto Ricos economic development by providing tax incentives on interests dividends and capital gains realized or accrued after the Individual Investor becomes a bona fide resident of PR. Act 20 and Act 22 now collectively known as Act 60 are tax incentives for US.

Act 60 consolidated various tax decrees incentives subsidies and benefits including Acts 20 and 22. Mainlanders to lure them into investing in and taking residency in Puerto Rico.

Puerto Rico Fbar Does Incentives Code 60 Avoid Filing

Puerto Rico Real Estate Mistakes To Avoid Relocate To Puerto Rico With Act 60 20 22

Pr Relocation Guidebook Short Relocate To Puerto Rico With Act 60 20 22

Tumblr Puerto Rico Sotheby S Realty Sotheby Realty Luxury Real Estate Caribbean Travel

Puerto Rico 39 S Act 20 And Act 22 Key Tax Benefits Insights Dla Piper Global Law Firm Law Firm Puerto Rico Insight

Investpr Annual Report Fiscal Year 2020 By Invest Puerto Rico Issuu

Win A Lares Trek Tour For Two In Peru Trekking Tour Inca Trails Inca Trail Hike

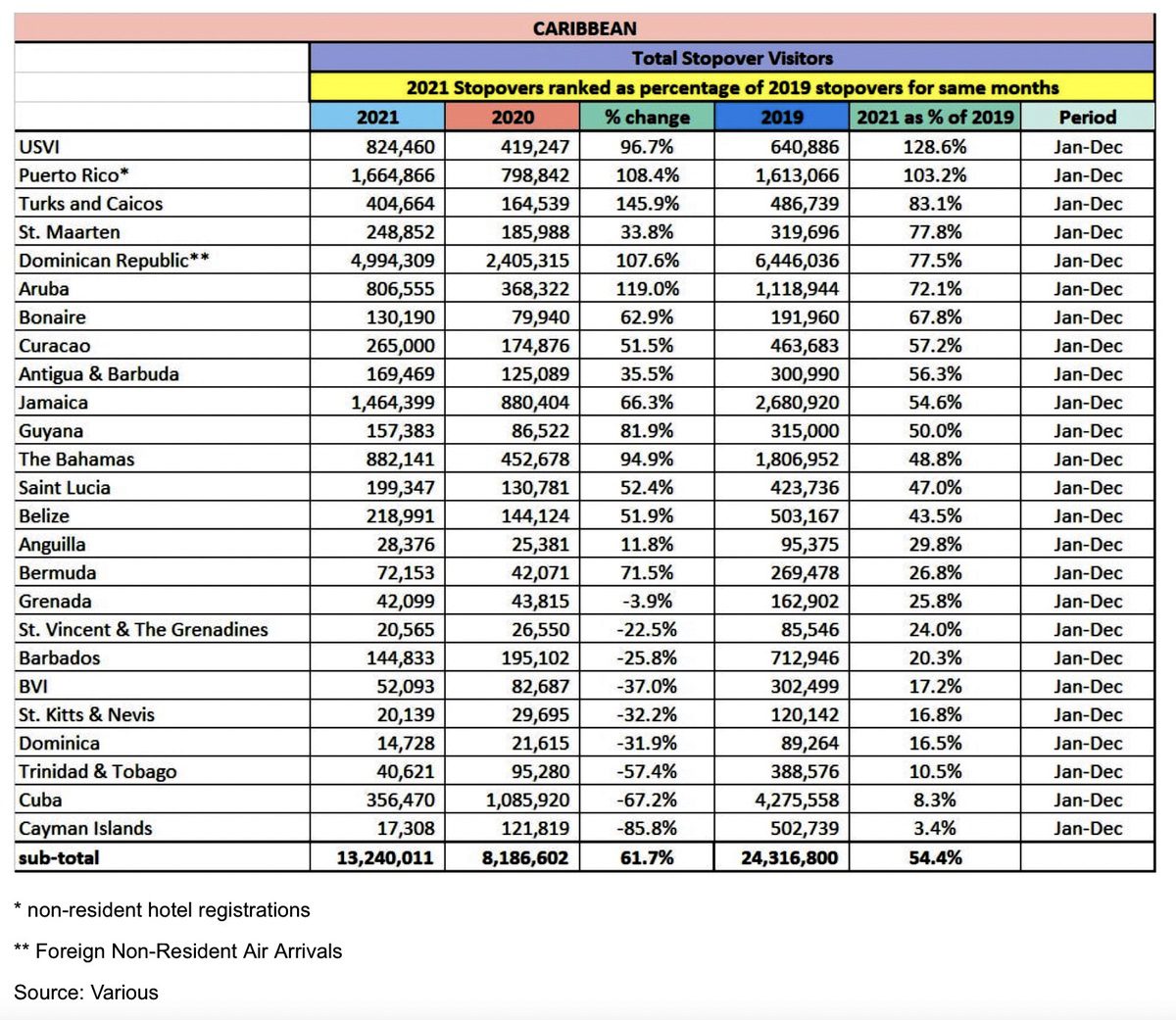

Puerto Rico S Recovery Offers These Lessons For Global Tourism

Act 20 22 Act 73 Puerto Rico Puerto Rico Vieques Luxury Property For Sale

Puerto Rico S Recovery Offers These Lessons For Global Tourism

Puerto Rico S Recovery Offers These Lessons For Global Tourism

Puerto Rico Tax Haven Is Alluring But Are There Tax Risks

Puerto Rico S Economic Development Opening With Acts 20 22 And Opportunity Zones Grant Thornton

Eligibility Guidelines For Puerto Rico S Act 60 Export Services Tax Advantages Relocate To Puerto Rico With Act 60 20 22

Resident Investor Individual Formerly Act 22 Torres Cpa

Omnia Economic Solutions Solutions Fictional Characters Character

Actionable 100 Year Analysis Of S P 500 What S The Best Strategy To Maximize Returns Strategies Stock Market Good Things

Puerto Rico Municipal Taxes Torres Cpa

Puerto Rico Incentives Code Act No 60 Now Officially In Effect